Glory Tips About How To Get Rid Of Personal Guarantees

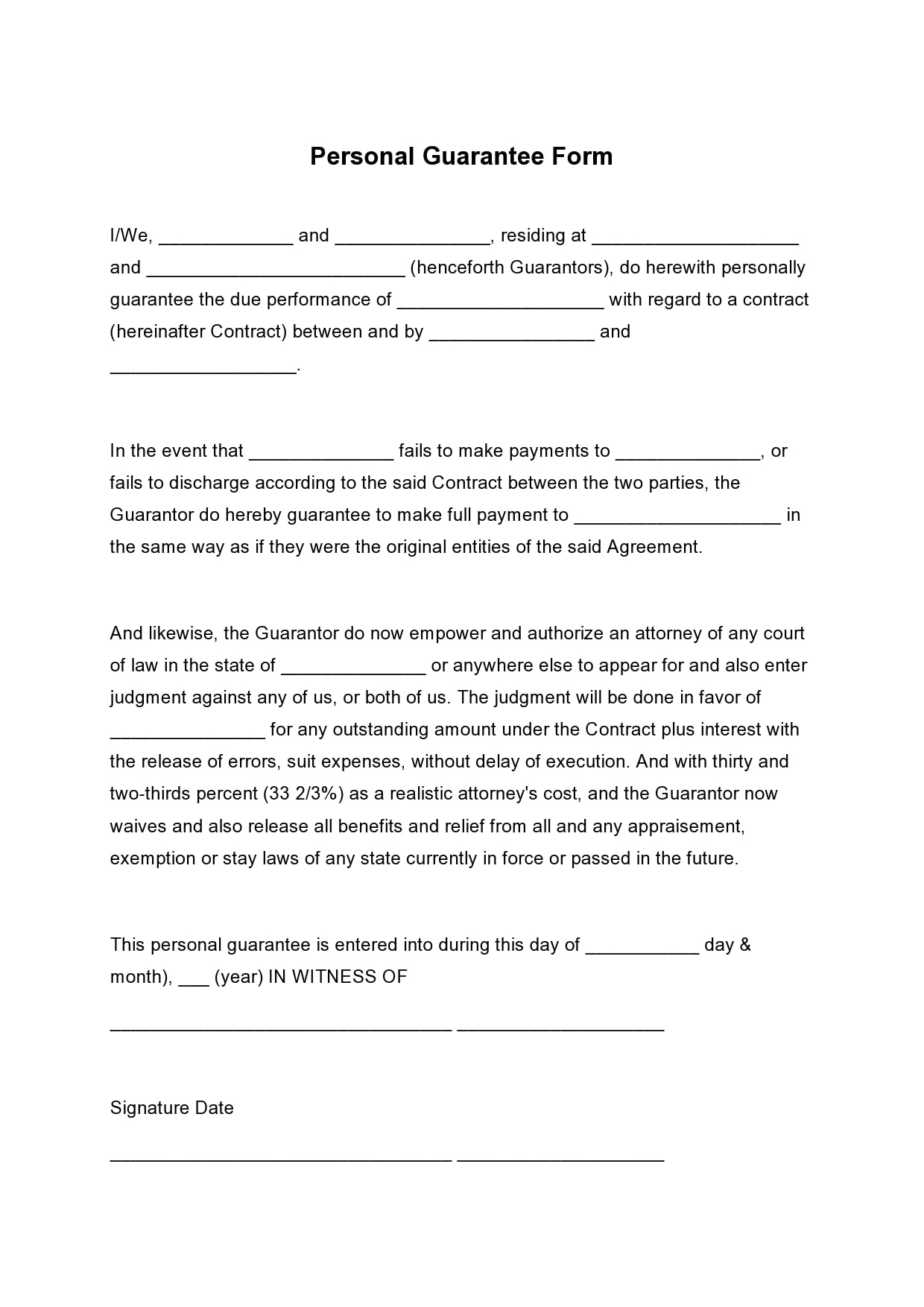

Bankruptcy can eliminate a personal guarantee on both business loans and personal loans.

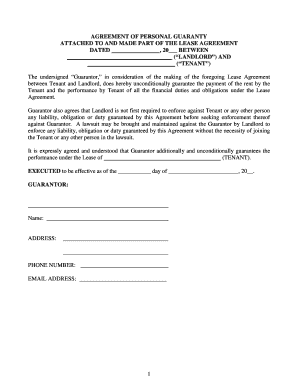

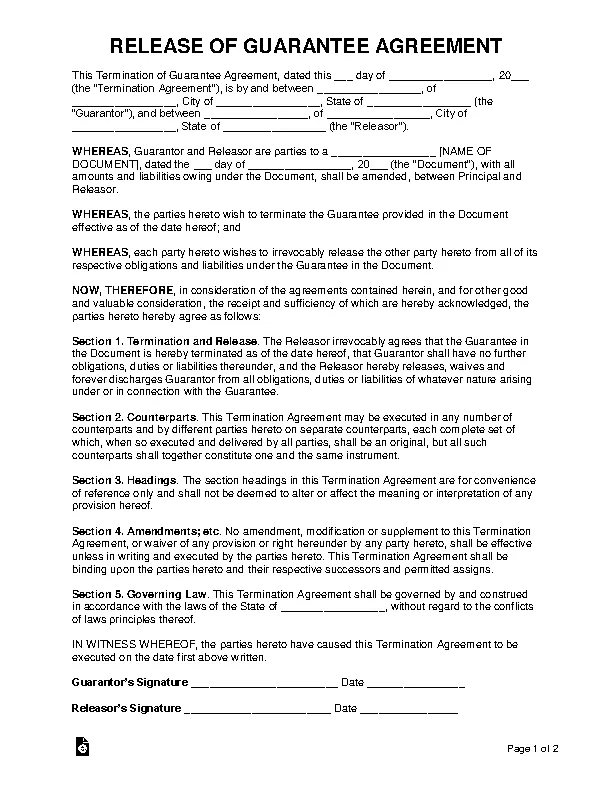

How to get rid of personal guarantees. Getting rid of a personal guarantee agreement once it’s signed is extremely difficult. To get out of a personal guarantee on a commercial lease in the uk, you will need to give written notice to your landlord of the intention to end the lease early, but if the terms have been. Subletting the space to another tenant is often the easiest way to.

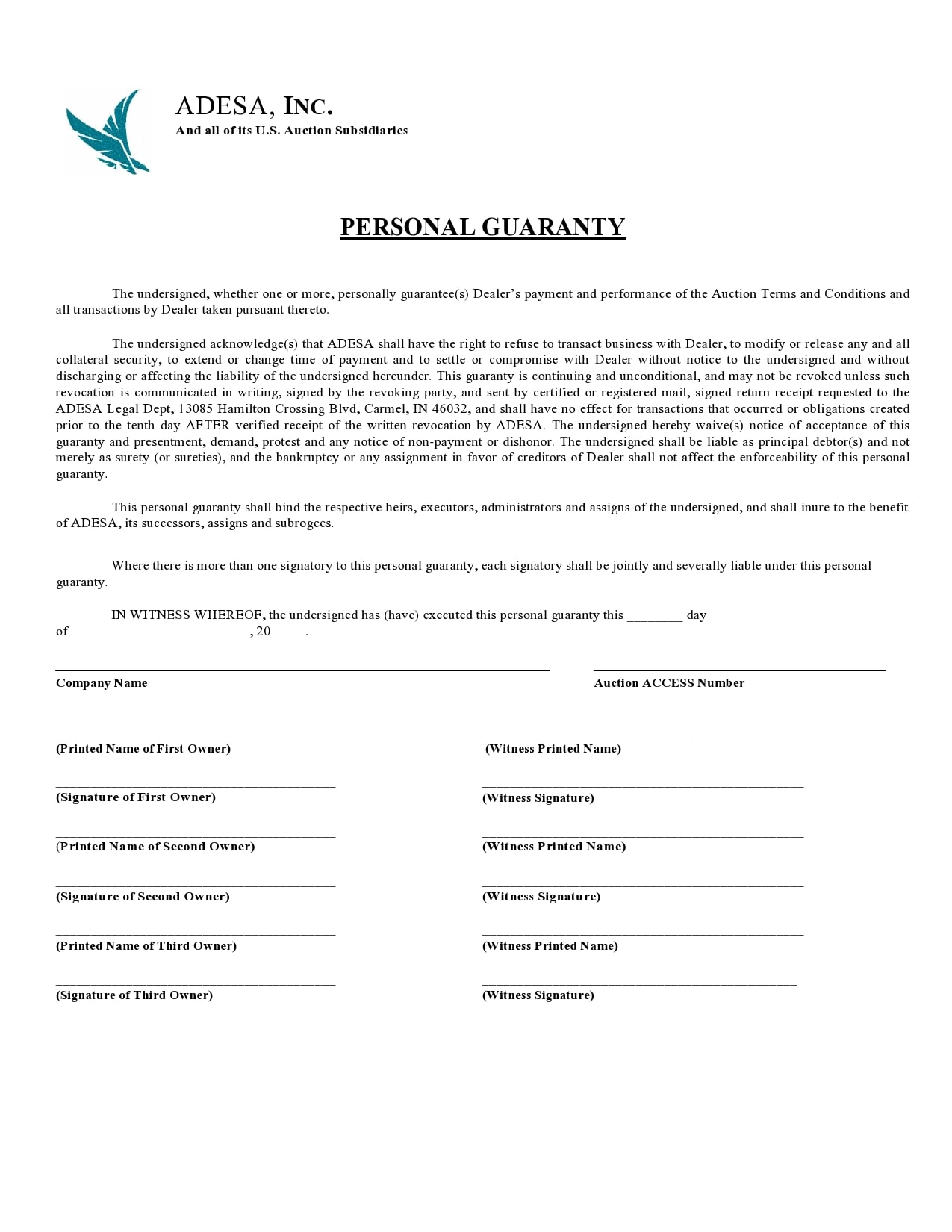

If, however, the business remains operational but you are no longer involved in the business due to buyout, divorce, etc., you will want the sba to release you from. Since a personal guarantee is an individual obligation, most people eliminate it by filing for bankruptcy themselves rather. Consequently, filing a chapter 7 bankruptcy will wipe out all liability including the personal guarantee.

Subleasing the space to another tenant. Also, keep in mind that. Browse our website to know more about bankruptcy.

It’s relatively common for a business owner to file individual bankruptcy to get rid of a personal guarantee—and most personal guarantees will qualify for discharge. An individual can discharge a personal guarantee. You can try and limit the amount of time you will guarantee the lease term.

The following are some pointers of reducing your personal exposure under the personal guarantee. How to get out of a personal guarantee on commercial lease? It’s difficult to get out of a personal guarantee before the loan is paid off.

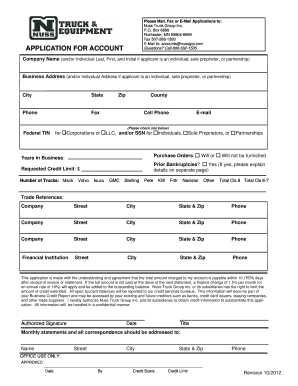

It’s important to note that if you file a chapter 11 bankruptcy and you are able to. I mean you can get rid of personal guarantees only if you sell your business and are released from the guarantee, or if you personally file for bankruptcy, said zach reece, a. Up to 25% cash back because your business was new, the bank asked you to execute a personal guarantee.